Minimal Asset Process (MAP)

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

What Is A Minimal Asset Process?

Available only to residents of Scotland, Minimal Asset Process or MAP Bankruptcy is a type of debt solution that is designed for individuals who are struggling to pay their debt in reasonable time and may need portions of it written off. Those who normally opt for MAP have a low income and few assets and therefore perhaps do not qualify for a Trust Deed.

The Minimal Asset Process tends to be easier and cheaper than sequestration, the Scottish equivalent of bankruptcy.

MAP last for 6 months, it doesn’t require any monthly payments and it can only be set up through an approved Money Advisor.

- Have debt between £1,500 and £17,000

- Not be a homeowner

- You Live in Scotland

- Have assets with a value of no more than £2,000, with no single item being worth more than £1,000

- Own a car with a value of no more than £3,000

- Not have a previous sequestration within the previous 5 years

- You should have a low income that covers your essential living costs, but leaves you with no more money or have an income made solely of income-based benefits e.g. Jobseekers/employment support allowance.

What Fees Minimal Asset Process Does a MAP Involve and How Do I Apply?

When you apply for a Minimal Asset Process (MAP), there is a fee of £90. This fee is payable to the Accountant in Bankruptcy (AiB) and must be made in order for the application to be processed.

There are plenty of charities that can help you through this process without adding any further fees, but bear in mind that some companies may add their own fees on top.

To apply for a Minimal Asset Process (MAP), you will need to contact an approved Money Advisor, however, the process is simple:

- Using the Common Financial Tool, they will look at your income and outgoings and calculate whether you could pay back your debts in a reasonable timeframe.

- You will need to pay the £90 fee.

- Your Trustee will notify your lenders that you have entered into a MAP and that you can stop paying towards your debt

- The MAP will last 6 months, at which point you will be discharged from it, and your debt will be written off.

- You will then be put under a set of restrictions that will last a further 6 months.

- If you gain any assets within a 4 year period of being discharged from the MAP, then the Trustee will be able to seize them and sell them to contribute towards your debt.

What Are The Advantages and Disadvantages of a Minimal Asset Process?

Advantages

- The £90 fee is much cheaper than a sequestration

- You can include most types of unsecured debts

- Once it has been approved, your lenders will no longer be able to chase you

- It is a legally binding agreement, but you will not need to appear in court

- You will be discharged after only 6 months

- All debts included will be written off

Disadvantages

- There is a possibility it could affect your job if you work within the financial sector

- You will find it difficult to get credit for the next 6 years

- If you rent privately, you may be refused a renewal of your contract. This could lead to you being evicted

- Your bank may freeze your account or downgrade you to a basic account.

- Your details will be entered on to the Accountant in Bankruptcy’s Insolvency Register, which is a public record.

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

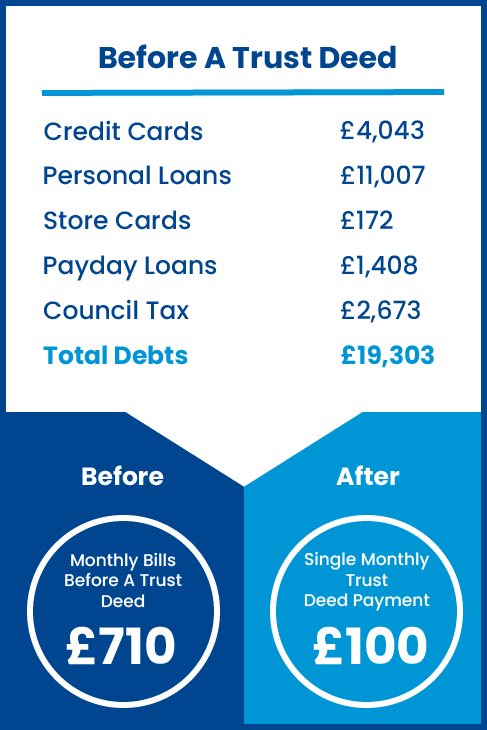

How Could A Trust Deed Help You?

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Friendly & Understanding

Our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their money worries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What is a minimal asset process (MAP) in the context of a trust deed?

A MAP is a debt relief solution available in Scotland that allows individuals with few assets and low income to address their debts. Its an alternative to sequestration, which is similar to bankruptcy. In the context of a trust deed, its another form of insolvency for those who do not meet the criteria or cannot afford the payments that come with a Protected Trust Deed.

How does one qualify for a minimal asset process?

To qualify for MAP, you must have total debts between £1,500 and £25,000, have little or no disposable income (after essential living costs), total assets worth less than £2,000 with no single asset worth more than £1,000 (excluding a vehicle), and not have been through MAP or sequestration in the last 10 years.

What impact does entering into a minimal asset process have on an individual’s income?

When entering into MAP, there isnt much direct impact on ones current income since its designed for individuals with low income. However, it requires that applicants have little disposable income left after essential expenses. Applicants must also disclose all sources of income during the application process which may affect eligibility.

Can someone under a MAP continue understanding and managing their finances independently?

Yes, individuals can still manage their day-to-day finances independently; however, they are required to adhere to certain restrictions regarding obtaining credit and they cannot act as company directors while under MAP. They should also seek financial advice before making significant financial decisions during this period.

What happens after successfully completing the minimal asset process?

After successfully completing MAP—typically within six months—individuals are discharged from their debts included within the program. This discharge means theyre no longer legally responsible for these debts. The completion also leads to certain entries in public records like the Register of Insolvencies but could potentially allow them to make a fresh financial start without those debts.