Sequestration

- Stop Creditor Calls

- Freeze Interest and Charges

- Free, No Obligation Consultation

- Discover The Right Solution For You

May not be suitable in all circumstances. Fees may apply, read here. Entering into a Protected Trust Deed may affect your credit rating.

What Is A Sequestration?

Sequestration or Scottish Bankruptcy is a type of debt solution available to residents of Scotland. Whilst the rest of the UK has bankruptcy, Scotland has sequestration. The two solutions are very similar.

As with the Scottish Trust Deed, you will need to appoint an Insolvency Practitioner (IP) to guide you through the process. By appointing an IP, you are authorising them to act as a ‘Trustee’ on your behalf and your finances and ‘estate’ become ‘sequestrated’. This means the IP will be able to take over the control of your accounts and will be authorised to contact your creditors.

A sequestration lasts for four years like a Trust Deed, but is designed for those who have little to no disposable income and are therefore not able to pay off any of their debts within a reasonable timeframe.

How Does Sequestration Work?

Once you have appointed your Insolvency Practitioner, they will begin to investigate any assets you have to see if they could be sold and used to contribute towards your debt.

This could result in your home being sold, but it is much more likely to result in your IP exploring whether any equity could be released from your property instead. If the IP thought that selling your property was a likely outcome, you would be notified before the sequestration process became official and you could opt not to proceed.

Whilst sequestration lasts for 4 years, much of the process is often completed in the first year if you are co-operative. At the end of this first year, the Accountant in Bankruptcy might ‘discharge’ you from the process, but you would still be expected to continue with any payments that were required for the following 3 years.

Once the process is complete, any remaining debt will be written off.

Once the sequestration has been approved, your details will be entered onto the Register of Insolvencies, controlled by the Accountant of Bankruptcy. This is a public record.

- Have over £1500 of debt

- Have been a resident of Scotland for 6 months

- Have not been the subject of a sequestration in the last 5 years

What Are The Advantages and Disadvantages of Sequestration?

Advantages

- Most of your unsecured debt should be included

- Your creditors do not have to agree to be included

- Your creditors will not be able to contact you or take any further action against you

- Your unsecured debts will be written off once the arrangement has completed

- You could be debt free in 4 years

Disadvantages

- Your credit rating will be negatively affected

- You will not be able to hold the post of company director during the process

- Some jobs do not allow you to be sequestrated e.g. police force, prison service or financial services roles.

- There is a chance your assets could be sold to fund your creditors

- Your details will be entered onto a public record

Credit Cards

Unsecured Loans

Store Cards

Overdrafts

Personal Loans

Utility Bills

Business Debts

Catalogues

Debt Collectors

Bailiffs

Whether it is a Trust Deed, Sequestration or a Debt Arrangement Scheme, only unsecured debt can be included in a debt solution.

Here are some examples of some typical unsecured debts that you may have.

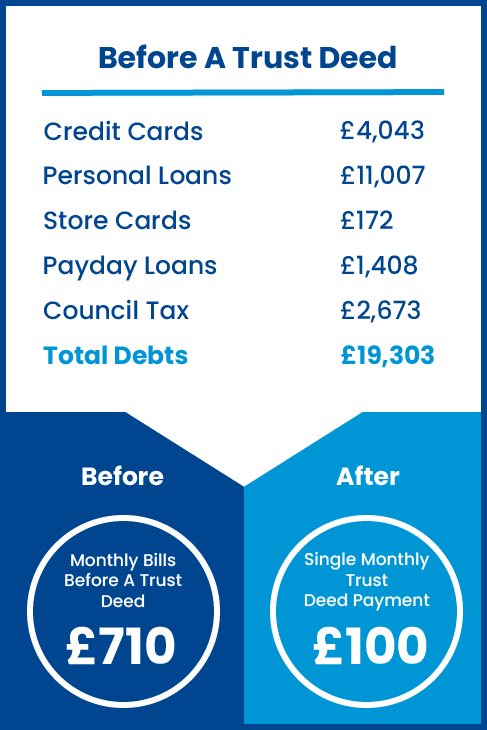

How Could A Trust Deed Help You?

Remember, if you are struggling with debt, you are not alone. Contact us at TrustDeed4Me to take the first step towards a debt free life.

This is a real life example of how we have helped one of our customers. Click on our link below to see how we could help you.

Friendly & Understanding

Our friendly, understanding and expertly trained advisors are ready to assist you, offering impartial and practical guidance in a completely non-judgmental setting. We recognise that anyone can encounter financial challenges, which is why we prioritise treating our customers with empathy and understanding.

Proven Track Record

With over 20 years of experience, we have helped literally thousands of people solve their money worries. Once you have enquired, one of our team members will be in touch, learning about your specific circumstances and pointing you in the direction of the help you need; whether that is with us, or one of our trusted partners.

Ongoing Support

If you choose to become one of our clients then, should you need us, we are here to help. We understand that life can be tough and we can all be faced with the unexpected from time to time, so should your circumstances change during your Trust Deed term, get in touch and get the support you need.

What is sequestration in the context of income, creditor, and insolvency practitioner?

Sequestration refers to a legal process in which an insolvent individuals estate is seized and managed by an insolvency practitioner with the goal of repaying creditors through the liquidation or orderly distribution of assets.

How does sequestration affect an individual’s income?

During sequestration, an individuals disposable income—after essential living costs—are often required to be contributed towards repaying debts. This contribution may continue for a period specified by law or the terms of the sequestration order.

What role does a creditor play in the sequestration process?

A creditor can initiate sequestration proceedings if they are owed money and believe that the debtor cannot fulfill their obligations. Creditors must prove there is sufficient cause for sequestration and may receive a proportionate share of any proceeds from the sale of assets.

How does an insolvency practitioner facilitate sequestration?

An insolvency practitioner (IP) oversees the entire process, including valuing and selling assets, managing finances, distributing funds to creditors, and ensuring legal compliance throughout the procedure. The IP acts as a trustee of the bankrupt estate.

Can an individual’s income improve after being subject to sequestration?

Yes, individuals can potentially improve their financial situation after being subject to sequestration. Post-bankruptcy discharge (usually after 1 year), they can start rebuilding their credit score and financial standing without the burden of previous debts; however, access to credit might initially be limited.